Savings accounts for young adults and minors Savings for young adults and minors

JustU Savings accounts

Build money management skills as you head into adulthood.

JustU Share Certificates

Get a boost on savings when you're just starting out.

Minor Savings accounts

Help your children be prepared for the future.

Minor Share Certificates

Save for short- and long-term goals.

Savings accounts for young adults and minors Savings for young adults and minors

JustU Savings accounts

Build money management skills as you head into adulthood.

JustU Share Certificates

Get a boost on savings when you're just starting out.

Minor Savings accounts

Help your children be prepared for the future.

Minor Share Certificates

Save for short- and long-term goals.

Digital Services

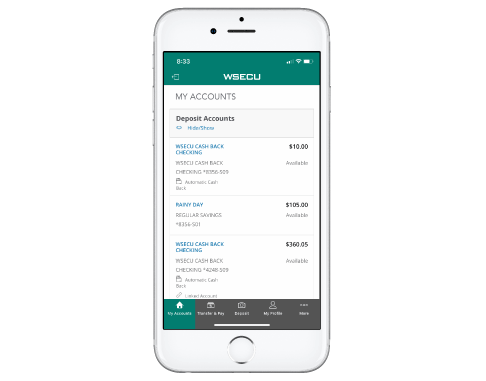

Mobile Banking

- Manage your account settings and profile.

- Sign in securely using biometrics.

- Deposit checks from your mobile device.

- Transfer money to your external accounts.

- Temporarily lock and unlock your cards.

Scan this code to learn more about our mobile app.

Digital Services

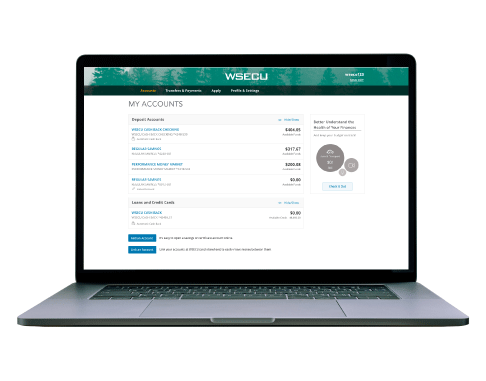

Online Banking

- Send money to other member accounts.

- Transfer funds to your accounts at other financial institutions.

- Receive customized account alerts.

- View eStatements.

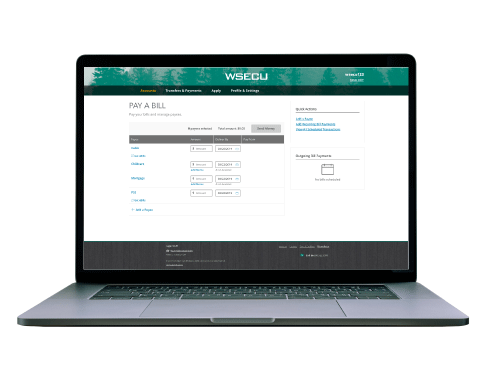

Bill Pay

Available for members over 14 or for younger members who have adult joint account holders. Checking account required.

- Set up and manage payees.

- Schedule payments through Online and Mobile Banking.

- Receive eBills from participating payees.

- Set payment reminders.

- Schedule automatic payments.