Business Money Market Accounts

- Tiered rates that adjust with your balance

- No minimum balance requirement

- No maintenance fees

- Payroll deduction

Business Money Market Accounts

- Tiered rates that adjust with your balance

- No minimum balance requirement

- No maintenance fees

- Payroll deduction

How much could you save with a business money market account?

Whether you have a clear savings goal with a dollar amount in mind or want to know what your earnings could be, our calculator has the answers.

Money Market Savings Calculator

Digital Services

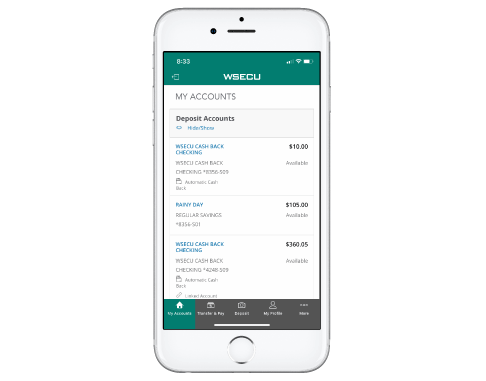

Mobile Banking

- Manage your account settings and profile.

- Sign in securely using biometrics.

- Deposit checks from your mobile device.

- Transfer money to your external accounts.

- Temporarily lock and unlock your cards.

Scan this code to learn more about our mobile app.

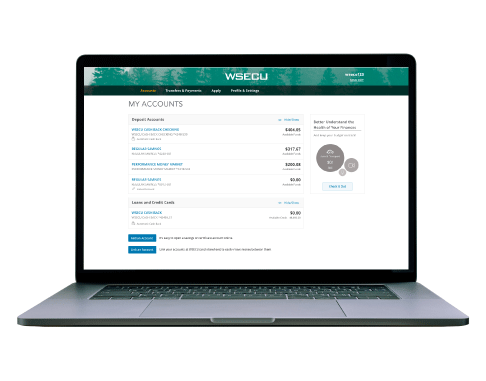

Digital Services

Online Banking

- Send money to other member accounts.

- Transfer funds to your accounts at other financial institutions.

- Receive customized account alerts.

- View eStatements.

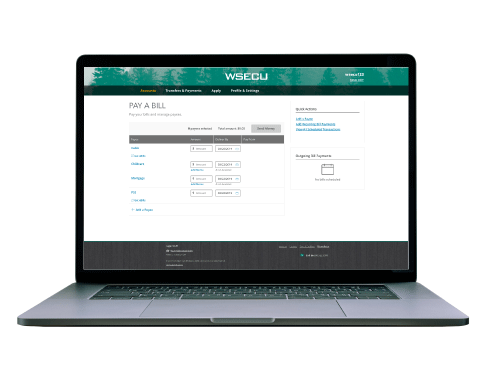

Bill Pay

- Set up and manage payees.

- Schedule payments through Online and Mobile Banking.

- Receive eBills from participating payees.

- Set payment reminders.

- Schedule automatic payments.

FAQ

All three account types make access to cash easy. However, there are a few differences in how they work.

Checking accounts are best for regular day-to-day money moves. They typically provide the lowest yields and often have associated debit cards for convenient cash access almost anywhere. It is not common for checking accounts to pay earnings.

Savings accounts are good for funds that need to remain available but not for everyday use. Without debit cards, savings accounts must be accessed through withdrawals or transfers. Consider savings accounts like “rainy day funds” that earn a small return.

Business money market accounts are a good method for saving money when the funds will not need to be accessed frequently. Business money market earnings are higher than those typically received from a savings account, yet there’s comfort knowing the cash is accessible any time.

Savings accounts are best when members make frequent withdrawals from their accounts. For members who make six for fewer withdrawals per month, business money market accounts may be a better option.

Members may make up to six withdrawals per month. Withdrawals may be in the form of checks, electronic transfers to other accounts or cash withdrawals.

There are no minimum balance requirements for business money market accounts.

Dividends begin once you make a deposit. Average daily balance is calculated at the end of each month.

Washington business owners also like ...

Merchant Services

Business Platinum Rewards Visa® card

Earn rewards points without paying an annual fee.

Learn more about the the business Platinum Rewards credit card