Checking accounts for everyone in Washington Checking Accounts

Enjoy early direct deposits with one of our hassle-free checking accounts.

Cash Back Checking

Earn cash back automatically.

Balanced Checking

Stay within your balance and enjoy automatic round-up savings.

Basic Checking

Hassle-free with no monthly service fees.

Checking accounts for everyone in Washington Checking Accounts

Enjoy early direct deposits with one of our hassle-free checking accounts.

Cash Back Checking

Earn cash back automatically.

Balanced Checking

Stay within your balance and enjoy automatic round-up savings.

Basic Checking

Hassle-free with no monthly service fees.

Cash Back Checking Accounts

Cash Back Checking

A debit card with rewards for your everyday purchases.

- If you have direct deposit (greater than $1,000 monthly), automatically receive 1% cash back on gas, restaurant and airline purchases and $0.05 cash back on other debit card purchases.

- If you don't have direct deposit, automatically receive $0.05 cash back on debit card purchases.

- Get your paycheck up to two days early with Early Direct Deposit.*

- Send money to anyone with free PayItNow P2P Transfer.†

- Write personal checks for $1 per check.

- Free eStatements; mailed paper statements available for $3/month.

- No monthly service fee.

Cash Back Checking Details

-

Auto Savings FeatureUp to 1% cash back on purchases with direct deposit of $1,000+ per month

-

Check Writing$1 per processed check

-

Monthly Fee

-

Minimum Balance Requirement

- 1% cash back on gas, restaurant and airline purchases (with $1,000 monthly direct deposit)

- $0.05 cash back on other purchases (with $1,000 monthly direct deposit)

- $0.05 cash back on purchases without direct deposit

- Courtesy Pay available*

- Paper Statements ($3 per month)

- WSECU Debit Card

- Online Banking & Bill Pay

- Overdraft Protection

- eStatements

- PayItNow P2P Transfer†

- Early Direct Deposit*

Balanced Checking Accounts

Balanced Checking

Build healthier financial habits and save more with our round-up savings checking account.

- Every debit card purchase is rounded up to the nearest dollar and the difference is transferred to your savings.

- No overdraft feesFees incurred due to withdrawing more funds than currently available in an account, but the financial institution allows the transaction to clear..

- Get your paycheck up to two days early with Early Direct Deposit.*

- Send money to anyone with free PayItNow P2P Transfer.†

- No personal checks.

- Free eStatements. Mailed paper statements not available.

- Monthly account fee is $5.

Balanced Checking Details

-

Auto Savings FeaturePurchases rounded up and difference transferred to savings

-

Check Writing

-

Monthly Fee$5

-

Minimum Balance Requirement$0

($50 for round-up savings to occur)

- No overdraft feesFees incurred due to withdrawing more funds than currently available in an account, but the financial institution allows the transaction to clear.

- Round-up automatically transferred to savings

- WSECU Debit Card

- Online Banking & Bill Pay

- Overdraft Protection

- eStatements

- PayItNow P2P Transfer†

- Early Direct Deposit*

Basic Checking Accounts

Basic Checking

Like to keep it simple? Try this traditional checking account.

- Write personal checks for free.

- Get your paycheck up to two days early with Early Direct Deposit.*

- Send money to anyone with free PayItNow P2P Transfer.†

- Free eStatements; mailed paper statements available for $3/month.

- No monthly service fee.

Basic Checking Details

-

Auto Savings Feature

-

Check WritingAvailable for free

-

Monthly Fee

-

Minimum Balance Requirement

- Courtesy Pay available**

- Paper Statements ($3 per month)

- WSECU Debit Card

- Online Banking & Bill Pay

- Overdraft Protection

- eStatements

- PayItNow P2P Transfer†

- Early Direct Deposit*

Digital Services

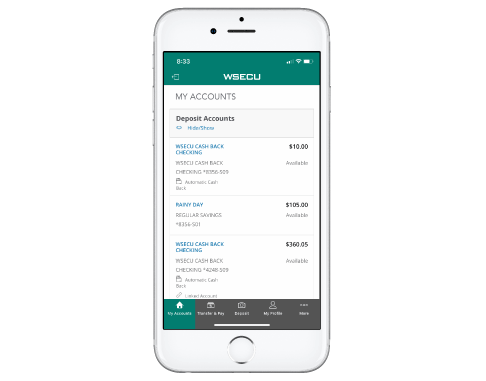

Mobile Banking

- Manage your account settings and profile.

- Sign in securely using biometrics.

- Deposit checks from your mobile device.

- Transfer money to your external accounts.

- Temporarily lock and unlock your cards.

Scan this code to learn more about our mobile app.

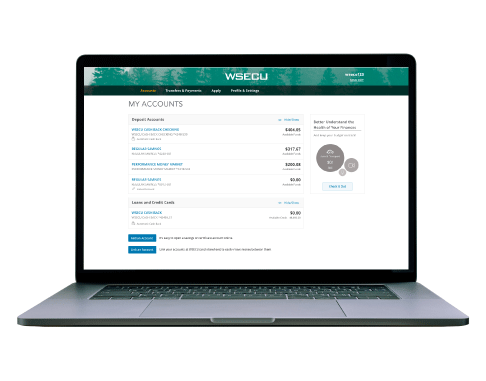

Digital Services

Online Banking

- Send money to other member accounts.

- Transfer funds to your accounts at other financial institutions.

- Receive customized account alerts.

- View eStatements.

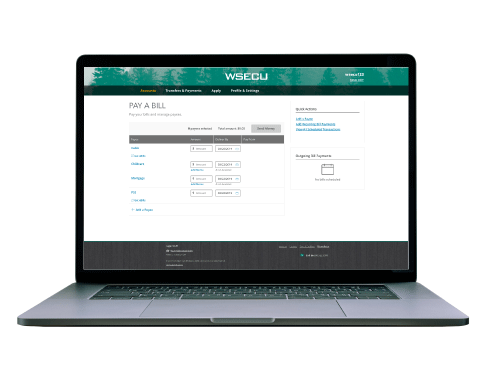

Bill Pay

- Set up and manage payees.

- Schedule payments through Online and Mobile Banking.

- Receive eBills from participating payees.

- Set payment reminders.

- Schedule automatic payments.