Skip-a-Pay

Information on skipping payments

Skip a monthly payment at your discretion

Skip-a-Pay is a handy WSECU benefit you probably didn’t even know you had. If your loan is eligible, you can skip your next payment for a $35 processing fee.

Tip: To avoid any delays, please have $35 for the processing fee in your WSECU account. The fee must be paid at the time of processing your request. You may also choose to pay the fee when submitting your request through Online Banking.

In cases of financial hardship, please contact our Member Solutions team at 800.893.7689 or make an appointment to talk to a Financial Coach. We’re here to help you.

Things to know about Skip-a-Pay

- Although you can skip a payment, interest will continue to accrue.

- Automatic payments may need to be managed separately.

- Some loan types are not eligible (for those, the option will not appear). See below for details.

- Some restrictions may apply. See below for details.

- Borrowers can access Skip-a-Pay in Online Banking, at a branch or by calling 800.562.0999.

- Co-signers making payments from a WSECU account can request Skip-a-Pay at a branch or by calling 800.562.0999. If payments are made by cash or check, co-signers must visit a branch for assistance.

- Eligible accounts that are past due still qualify for Skip-a-Pay and double skip if the delinquency is fewer than 60 days.

- If you have WSECU GAP insurance, the coverage may not extend beyond the original maturity date of the loan. Up to six skipped payments are permitted over the life of the loan. If you purchased dealer GAP insurance, please reach out to your provider to see how skipping a payment will impact your coverage.

Double skip

Now you can skip two consecutive payments on eligible loans and credit cards. Please note that each skip must be processed separately. After processing the first skip, if your next payment is due within 30 days, you may immediately process your second skip. If your next payment due date is more than 30 days away, you will not be able to process a second skip until the payment due date is within 30 days.

Visa® credit cards are an exception. Because their payment cycles always begin on the 18th day of the month, Visa credit cards do not become eligible for a skip until the 18th day of the month prior as long as all other eligibility requirements are met.

How to Use Skip-a-Pay

How to use

Be sure to have the $35 processing fee in your account when making your request. You may transfer funds from a different financial institution using:

- Mobile deposit

- ACH transfer

- External account transfer

- In-person branch or shared branch deposits

How to use Skip-a-Pay on Online Banking

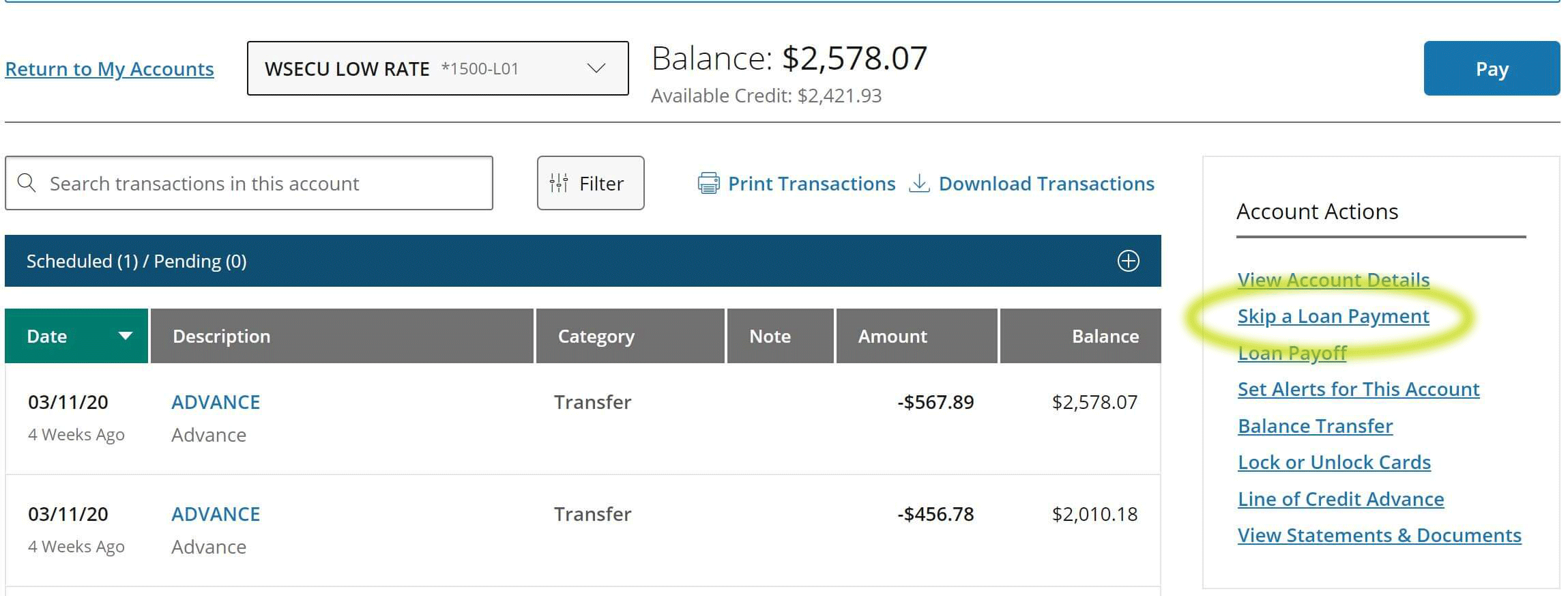

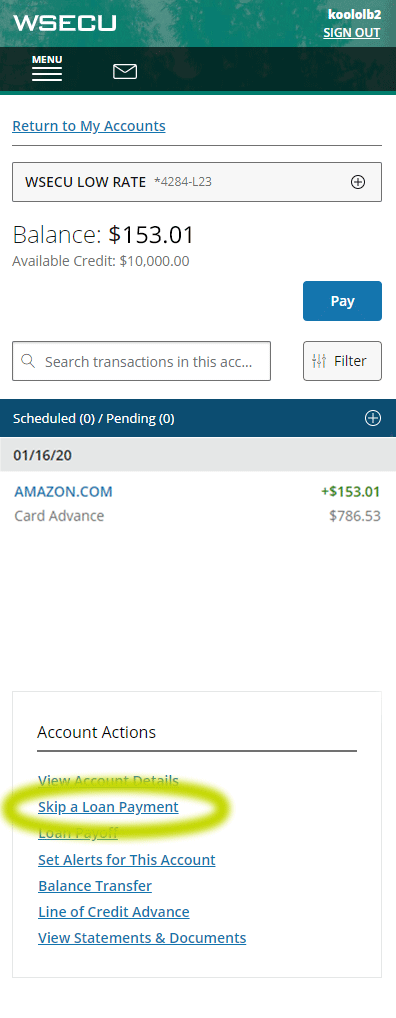

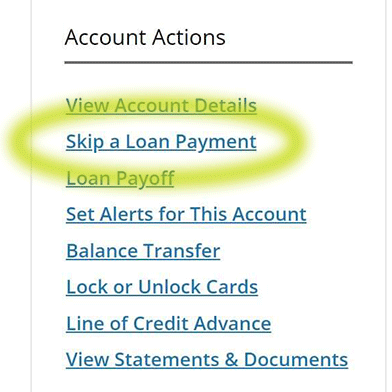

Online Banking: Access Skip-a-Pay from the Quick Actions menu.

How to use Skip-a-Pay in Mobile Banking

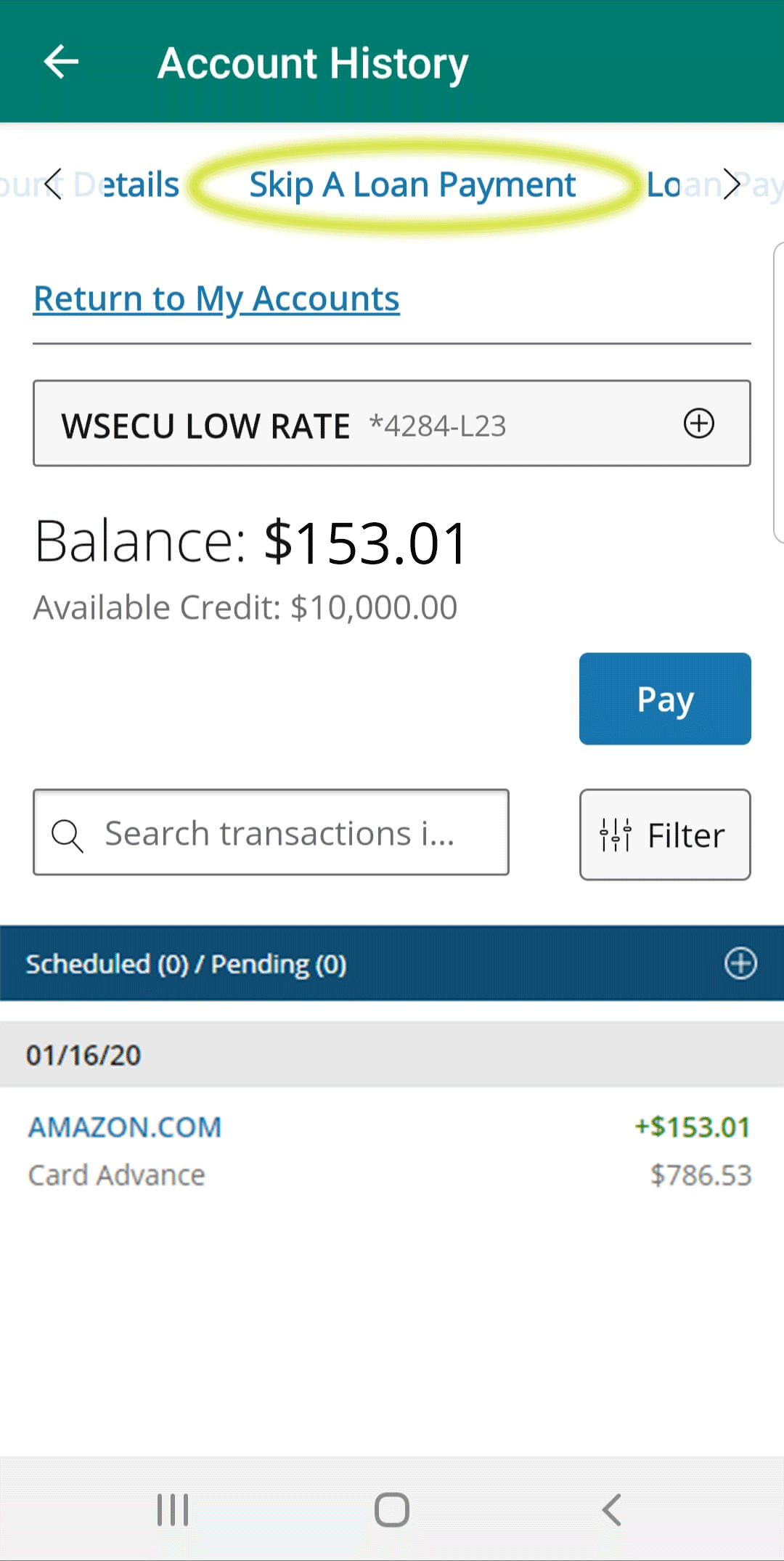

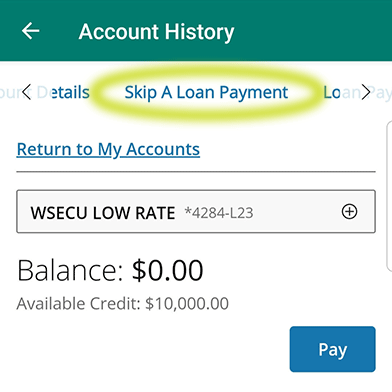

Mobile Banking: Access Skip-a-Pay on the top carousel menu inside Loan Transaction History.

Eligibility and fine print

Restrictions and fees

- Auto, personal loans, personal lines of credit and credit cards: Typical fee is $35 per skip.

- Non-revolving loans, such as auto loans, are allowed a maximum of 6 skips for the life of the loan, with a maximum of 3 skips in a rolling 12-month period.

- Revolving loans, such as credit cards and lines of credit, are allowed an unlimited number of skips with a maximum of 3 skips in a rolling 12-month period.

- One double skip is allowed in a 90-day time period. It is not a requirement to take 2 consecutive skips. A minimum of 90 days and 3 loan payments is required for a loan to be eligible for a new skip.

Not eligible for Skip-a-Pay

Most WSECU loans are eligible for Skip-a-Pay with the following exceptions:

Creating a Budget

Need help with budgeting?

Our free online resources can provide a few extra tips and strategies to help you calculate a budget that best suits your current needs.